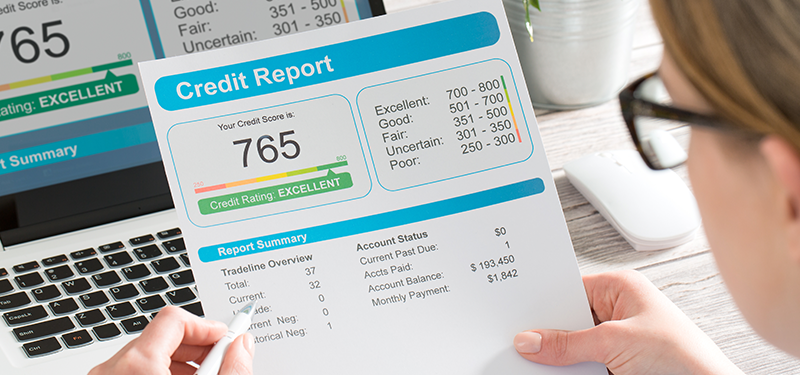

Increase your credit score this year

One of the most important changes you can make, and one that will likely have the biggest impact, is to improve your credit score.

Okay, I know that doesn’t sound half as appealing as getting that beach body for the summer, or a resolution to travel to some exotic local. But improving your credit and getting a higher credit score is the type of resolution that will massive benefits this year and throughout your life. Like lower interest rates on pretty much everything you use credit for – credit cards, car loan, mortgage, etc. And over a lifetime this will mean a substantial amount of money that you can spend however you wish. Sounds like a cool goal for the new year, right?

If you have had issues with your credit for a while, one thing that’s kind of cool when it comes to improving your score is that the time it takes recover is less if you have a lower starting score than if you’re starting with a higher score.

Example:

If your starting score is 680 FICO estimates it will take 9 months to fully recover from a missed mortgage payment.

If, though, your starting score is higher, 780, then FICO estimates it will take approximately 3 years to fully recover.

As you can see, with a lower current credit score you can make up a lot of ground on improving it over the course of the year.

Pay Your Bills

To get started let’s focus on the factors that really impact your credit score. The biggest factor affecting your credit score is your payment history. Or put another way – how well have you paid your bills on time? It’s important to remember, the credit score was developed for lenders to better understand the risk they were getting into by lending to a particular customer. And for those lenders knowing you are good at pay people back when you’ve agreed to is very important.

So as the first step to increase your credit score is to start paying your bills on time and keep paying them on time. That may be easier said than done, so here are some helpful pointers that might help.

Develop and live within a budget. If you have a budget that you adhere to then you’ll be sure to have enough money available when bills come due. By doing this you take all the risk out of whether there’ll be enough money “at the end of the month”. Not having control over your money is the leading cause missing payments. A budget you live by is the best way to get control back.

Next, set-up auto debit for all of your ongoing bills. This is usually pretty easy to do and most creditors have the ability for you to allow them to automatically take out your month payment. With this in place you’re pretty much guaranteed to not miss a payment.

Also, most creditors will allow you to set-up an alert to notify you a certain number of days in advance when your payment is due. For those creditors you don’t have auto debit, set-up a payment alert. Set the alert for 7 days before the payment is due, and then schedule the payment for the day it is due as soon as you get the alert. Don’t wait 7 days before you set-up payment for it.

Finally, try to use online payments for all of your credit accounts, if possible. It’s so much easier to track and pay your expenses online than the old school way of writing/recording a check, getting an envelope and stamp, and then making your way to a mailbox. Unless you’re old school disciplined to do all those things, and do them month in/month out, you’re much more likely to miss a payment this way. Take it all online where you can pay almost any bill in under a minute, and have an email confirmation it was received.

Get Your Debt Down

About 30% of your credit score is based on how much you owe, and how much of your available credit has been used. Together with your payment history, these two factors make up almost two-thirds of your credit score. Whip them into shape this year and you’ll be well on your way to a great credit score that you can sustain.

Like your payment history above, getting your debt down will usually take a little time to do. Unless you have a wealthy relative willing to help out or you win the lottery, paying debt down will require some sacrifices and discipline over time. But once you have the right habits in place it’s just a matter of sticking to it.

A couple quick pointers to help with this:

Like working on improving your payment history above, it’s best to start with a budget. A good budget will help you restrain your spending, and will show you how much you should have extra each month after all the bills have been paid. That extra amount left over should go to paying down your debt. And I would recommend treating that extra amount used for debt like you would a bill that must get paid.

Let’s say you have $100 extra at the end of each month. That $100 should be paid out to your outstanding debt each month just like you paid the electric bill. That way you’re making consistent payments that are both manageable and will make a real impact over time.

Next, look at all of your debt to determine which accounts are changing you the highest finance charges, and pay off the highest ones first. Finance charges are a killer when it comes to debt. It’s probably the biggest factor limiting our ability to climb out of the debt we’re in because each month it adds a little more debt for us to pay. And in those cases with accounts that have higher finance charges, it doesn’t add in a little more to pay, it adds in a lot more each month. That’s why it’s import to prioritize paying debt off by the highest finance charges first. With this approach you’ll reduce the total amount of finance changes paid while working through paying off all of your debt.

Credit Repair

The final step in the process for our increasing your credit score is performing credit repair for all your credit accounts in error. Even people with otherwise great credit can have errors on their credit reports. And these errors can have a real impact on your overall credit score in some cases.

With the first two areas of focus, payment history and debt, those are both areas where you have to largely push through them yourself – with discipline and some time. Credit repair is a little different. You can either choose to do it by yourself, or choose to have a professional handle it for you.

A good first step here is to evaluate a professional firm, like The Credit People, to see what they have to offer. If you think there’s good value in the service they have to offer, then a professional firm might be the way to go. Or, if you think you could do as well – then give it a try!

So those are the main steps needed to achieve a higher credit score. There’s a little bit of heavy lifting here but not too bad. And if followed, I’m pretty sure you’ll be happy with the results you get.