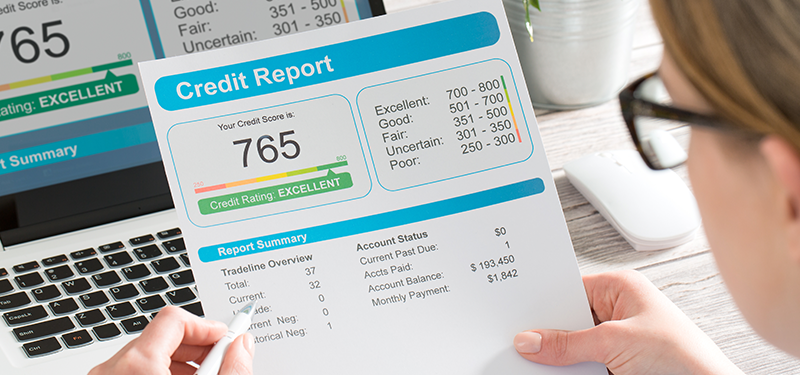

Higher credit score is in your future!

Ways to increase your credit score, and keep increasing it...if you stay consistent!

There's a few areas that really impact your credit score. Things like any missed payments or negative stuff, positive payment history, and debt. Let's start with debt, because this is usually the fastest way to get a boost in your score...

1. Lower your credit utilization

Let's start with the goal: Look at the available limit on any of your credit cards, then look at your balance, your goal is 30%. You want what you owe no more than 30% of the limit. Great, now we know our goal. If you're not there, here's some ways to get you there that we help our customers with when fixing their credit (and I'll breeze through these)...

Pay the minimum on everything and focus every penny you have on the highest interest card. While you're doing that, contact your credit card companies and ask for an increase in your credit card limit. If they give you an increase, do not use the new available limit. The whole point of asking for an increase is to make your "limit" higher, so that your "debt" seems lower--closer to that 30% goal.

Finally, while you're doing these things, see if you can get a personal loan in the amount of your credit card debt, or as much as you can, and pay down your credit cards with that. Doing this will make your credit utilization look better instantly! It works because your personal loan does not count toward your credit utilization. Very important reminder: Do not use those credit cards ever again until after you have paid off that personal loan. Otherwise you will now mess up your credit utilization once again, but you'll also have a personal loan to pay off on top of it!

Do this right, and you'll get big points back on your credit!

2. Become a co-user on someone's credit card that you trust (and has good credit)

3. Remove as many 'bad' things...credit mistakes from your past (or present)

This is where we shine. This is one of the biggest reasons why people hire us, because of our track-record of removing the credit issues on their credit that is killing their credit score. You want to use an accelerated dispute process which includes: Digital dispute, Escalated bureau investigation, MOV investigation requests.

The goal here is to make sure your dispute is received, acted on, and you have they have the best chances of succeeding. Your goal is to have any questionable negative issue on your credit removed based on your dispute.

A digital dispute ensures speed, but an escalated dispute means that you are contacting the creditors and bureaus with something unique and specific. You want to make sure a human being is reviewing your dispute whenever possible. Finally, you want to follow up on your dispute to make sure it was acted on properly, and within your rights. This is the purpose of opening a MOV investigation (Method of Verification).

4. Open and Apply for New Credit Accounts Only when you Need Them

Having too many credit cards can negatively affect your score. Think about it, this means that you have access to a lot of credit, which can be risky for creditors to keep giving you more access. Just a few cards is usually the right amount.